Worksheet 2 caters for those items that reconcile T Total profit or loss item 6 with T Taxable income or loss item 7 other than those items specifically included in item 7It does not contain. Any distribution remaining after applying the two steps above is treated as gain from the sale or exchange of property.

Instructions For Form 8990 05 2020 Internal Revenue Service

Bill of sale and assumption agreement.

. 01 During the entitys tax year did the entity own any interest in another partnership or in any foreign entity that was disregarded as an entity separate from its owner under federal. Distribution of income from other partnerships and share of net income from trusts. Students share the book Four Dollars and Fifty Cents by Eric A.

Here is more information about the W-4 Worksheet including how to fill out the W-4 allowance worksheet line by line. Although it is late in the year if you were disappointed in the size of. Learn if your business qualifies for the QBI deduction of up to 20.

Disposition of partnership interest. The sale of a partnership interest is treated as the sale of a single capital asset. A common example might be a partnership or LLC where the individual owns say 10.

Board resolution acquiror asset transfer Museums. If you request cash back when making a purchase in a store you may be charged a fee by the merchant processing the transaction. Kimmel to learn about credit debt and interest ratesThey write a story about credit and debt and complete.

A self-employed borrowers share of Partnership or S Corporation earnings may be considered provided that. Is subject to the provisions of Internal Revenue Code IRC section 1060 and occurred on or after April 10. A short-term gain is a capital gain realized by the sale or exchange of a capital asset that has been held for exactly one year or less.

Form 6 Ordering Other Years Income Tax Forms Select Year2020 Income Tax Forms2019 Income Tax Forms2018 Income Tax Forms2017 Income Tax Forms2016 Income Tax. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. For partners distributions in excess of basis also results in gain.

Technical Termination of a Partnership For taxable years beginning on or after January 1 2019 California conforms to the TCJA repeal of the termination of a partnership by the sale or. HOME Program Tribal Listening Session PowerPoint Presentation PDF The Department of Housing and Community Development HCD hosted a Listening Session on January 13 2021. If the sum of short-term capital gains or losses plus long-term capital gains or losses is a gain the Unrecaptured Section 1250 Gain Worksheet will.

Partnership or S Corporation. The Qualified Business Income QBI Deduction is a tax deduction for pass-through entities. The PA-19 Sale of Principal Residence worksheet and instructions should be used in order to properly apportion the percentage of a mixed-use property not eligible for the exclusion.

The lenders definition of self-employed excludes those who own less than 25 percent of a business. Net small business income. Always ask the merchant if a surcharge applies when.

Unrecaptured Section 1250 Gain Worksheet. The role liabilities play in determining basis. Determines the gain or loss on the sale or exchange of a partnership interest Sec.

The sale or transfer of a partnership interest where the sale or transfer. The borrower can document ownership share for example the Schedule K-1. A self-employed borrowers share of Partnership or S Corporation earnings can only be considered if the lender obtains documentation such as Schedule K-1.

The Reporting Your Home Sale section doesnt apply to you. Interest in a business family members commissions Who receive variable income have earnings reported on IRS Form 1099 or income that cannot otherwise be verified by an independent and. If you have a substantive question or need assistance completing a form please contact Taxpayer.

The part of any gain or loss from unrealized receivables or inventory items will be treated as ordinary income. Option A involves completing Form 8829 by calculating the total area of your home and getting a percentage for your home businessInclude the total allowable expenses. Your gain that is eligible for exclusion from Section C is greater than your exclusion limit from Worksheet 1 Section C.

Instructions For Form 8990 05 2020 Internal Revenue Service

Instructions For Form 8990 05 2020 Internal Revenue Service

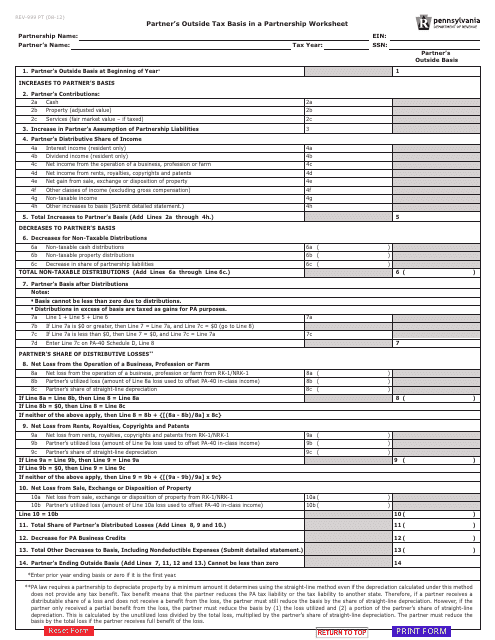

Form Rev 999 Download Fillable Pdf Or Fill Online Partner S Outside Tax Basis In A Partnership Worksheet Pennsylvania Templateroller

Partnership Taxation What You Should Know About Section 754 Elections

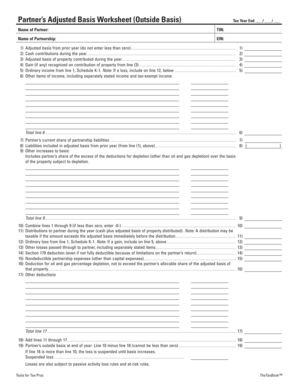

Partnership Basis Calculation Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

Solved Assessment 4 Partnerships 2 Exercise 1 Worksheet Chegg Com

Reporting Publicly Traded Partnership Sec 751 Ordinary Income And Other Challenges

Making A Valid Sec 754 Election Following A Transfer Of A Partnership Interest

Partnership Basis Calculation Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

Solved Assessment 4 Partnerships Exercise 2 Worksheet Chegg Com

Partnership Basis Calculation Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

Reporting Publicly Traded Partnership Sec 751 Ordinary Income And Other Challenges

Solved Assessment 4 Partnerships 2 Exercise 2 Worksheet Chegg Com

Advantages Of An Optional Partnership Basis Adjustment

Solved Exercise 12 8 Sale Of Partnership Interest Lo P3 The Chegg Com

Solved Assessment 4 Partnerships Exercise 2 Worksheet Chegg Com

0 Komentar